It could also signify that a company has a pretty strict credit policy while offering sales on credit to its customers. High Accounts Receivable Turnover RatioĪn increase in accounts receivable turnover ratio indicates that a company is efficient in collecting cash and has promptly paying customers.A high or a low receivable turnover tells us how quickly or slowly a company collects its receivables.

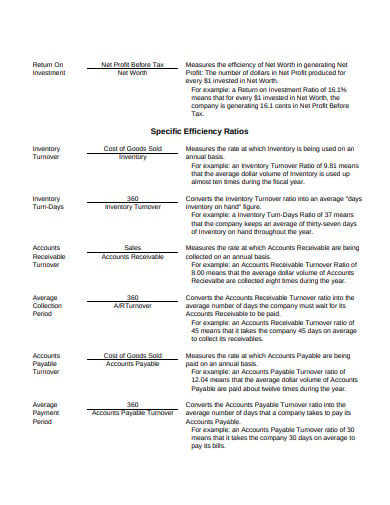

The accounts receivable turnover is used to analyze how effective a company’s revenue collection is, and that’s why it’s important. We’ll understand this in depth in the following sections. But if the customers are paying back within the policy time, the ratio is high, thereby contributing to a good accounts receivable turnover.Ī good accounts receivable turnover means that a business has a solid credit policy, an excellent due collection process, and a record of exceptional customers who pay their dues on time. With a 30-day payment policy, if the customers take 46 days to pay back, the Accounts Receivable Turnover is low. For instance, let’s talk about Company A’s payment policy itself. What is a Good Accounts Receivable Turnover?Ī good accounts receivable turnover depends on how quickly a business recovers its dues or, in simple terms - how high or low the turnover ratio is.Now, if Company A has a strict 30-day payment policy, the accounts receivable turnover days show that on average, customers pay late. This means, an average customer takes nearly 46 days to repay the debt to company A. Receivable turnover in days = 365/AR turnover ratio Now, it is also crucial to calculate the accounts receivable turnover in days. = /įrom the above calculation, we can conclude that company A has successfully collected accounts receivable eight times in a year.

0 kommentar(er)

0 kommentar(er)